EYES ON A NEW ERA: THE RESHORING AND NEARSHORING POTENTIAL FOR GERMANY AND EUROPE

The logistics real estate universe is going through turbulent times. Having endured two years of the pandemic without being able to vanquish the coronavirus, the world has learned to live with it. China takes exception as it pursues an extremely strict lockdown strategy for political reasons, which has lately culminated in the quarantining of Shanghai. The situation is compounded by the war in Ukraine that began when Russia invaded its neighbour on 24 February 2022. Apart from having turned into a humanitarian disaster on an unimaginable scale, the conflict transcends the national boundaries of Ukraine. In fact, it represents a hiatus with global ramifications and enough potential to substantially restructure the world for the first time since the end of the Cold War.

It was the pandemic that revealed the fragility of supply chains for all to see for the first time. But the Russian war of aggression against Ukraine and its downstream consequences are far graver. They dramatically exacerbate the problem of supply chain disruptions. Supply chains are not as resilient as they were assumed to be in a globalised world.

The following questions are therefore discussed with growing urgency:

- How can supply chains be protected in ways that makes manufacturing less susceptible to extreme events?

- How do we secure an uninterrupted flow of supplies for the population and industrial production even in difficult market phases?

An answer frequently offered is to roll back the dependency on foreign production, especially in Asia, and to minimise the need for long-distance haulage. The solution according to this argument would be to move production activities back to Germany (so-called “reshoring”) or at least back closer to home (so-called “nearshoring”). Another potential solution would be to expand storage capacity (so-called “stockholding”), especially in times when established production narratives are contested (a “just-in-case” approach favoured over “just-in-time” production).

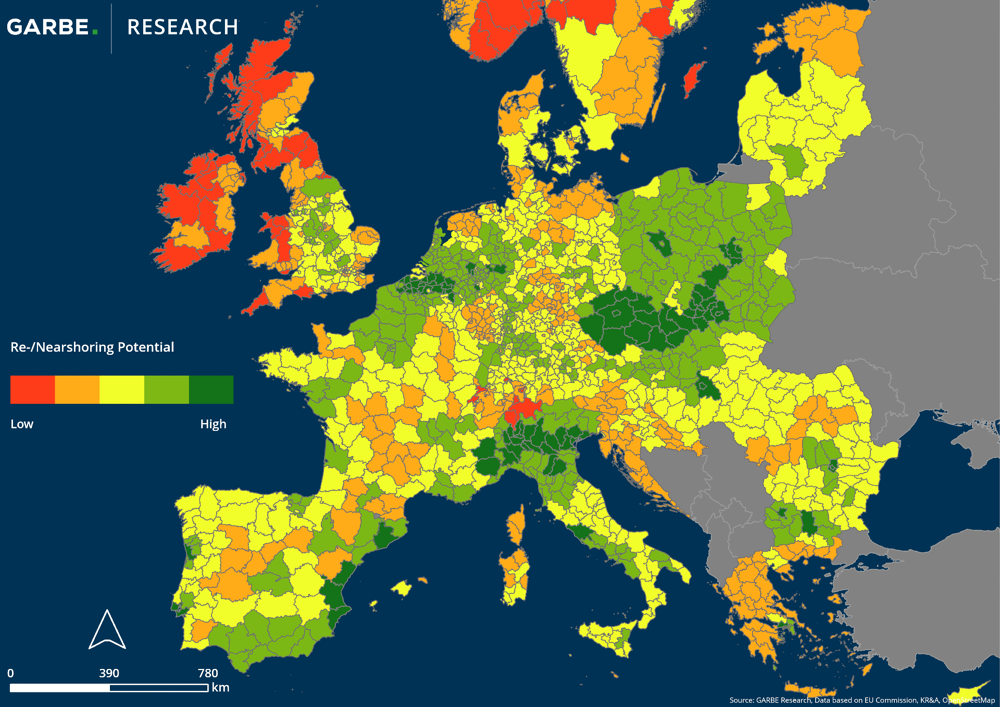

For GARBE, being a European provider of light industrial and logistics real estate along with corresponding investment products, such a scenario is plausible at least to some extent. But is the potential for its implementation equally distributed across the regions? Or are some areas better suited for it than others? GARBE Research used scenario modelling to find out. To this end, the key drivers that had originally prompted the outsourcing of manufacturing activities were determined in a first step. Wage and energy costs, for instance, play a fundamental role. But the modelling integrated a number of other factors as well. This made it possible to model the potential of each identified driver on a small-scale level in Europe (see map representation). If you are interested in additional details, please do not hesitate to get in touch with us.

www.garbe-industrial.com

Next Article

Container for the dynamic page

(Will be hidden in the published article)